Information Disclosure Based on TCFD Recommendations

Information Disclosure Based on TCFD Recommendations

We believe that climate change is one of the most important themes for our company, whose mission is to create new value and “to promote health and happiness through the enjoyment of nature and the world around us.” We analyze the risks and opportunities that climate change will bring to our business, evaluate the impact that climate change will have on our

business, integrate the response to risks and plans to take advantages of opportunities in our management strategy. We believe that this is important for the sustainable growth and enhancement of the corporate value of our company, as well as for contributing to the sustainability of society, and will disclose the progress appropriately.

Governance

The ESG Committee, established in May 2022, has been monitoring CO2 emissions and related reduction activities, as well as deliberating policies and measures to address climate change-related risks and opportunities, and reporting to the Board of Directors. In addition, the Environment Committee, Social and Ethics Committee, and Governance Committee were

established as subcommittees under the ESG Committee in April 2024 to enable effective promotion and more substantive discussions, led by the executive officer in charge of the Environmental Committee.

The Board of Directors, which receives reports based on deliberations by the ESG Committee after discussions at the Environment Committee, supervises and directs the appropriate promotion of measures to address climate change-related risks and opportunities.

*In the fiscal year ended December 2024, ESG Committee meetings were held four times and the outcomes were reported to the Board of Directors on four occasions.

The Board of Directors, which receives reports based on deliberations by the ESG Committee after discussions at the Environment Committee, supervises and directs the appropriate promotion of measures to address climate change-related risks and opportunities.

*In the fiscal year ended December 2024, ESG Committee meetings were held four times and the outcomes were reported to the Board of Directors on four occasions.

Strategy

To confirm the impact across the Group, in 2022 we qualitatively assessed climate-related risks and opportunities that could have a financial impact over the time frame until 2030. In 2023, we conducted a scenario analysis for the year 2030 using climate change scenarios (1.5- and 4-degree scenarios) from the International Energy Agency (IEA) and the

Intergovernmental Panel on Climate Change (IPCC). In the analysis of each scenario, we also quantitatively verified and assessed the impact of the qualitatively identified climate-related risks and opportunities on the business.

Of these, climate-related risks and opportunities that have a significant impact on the business are as shown in the table below.

Of these, climate-related risks and opportunities that have a significant impact on the business are as shown in the table below.

| Risks and opportunities | Changes in the external environment | Impact on the business | |

|---|---|---|---|

| Transition risks | Policy and regulations | Introduction of carbon tax, increase in carbon tax rate | Increase in costs |

| Reputation | Increase in the number of stakeholders who regard climate change response as one of the components of brand value | Decrease in sales revenue | |

| Physical risks | Acute | Intensification of typhoons and floods | Decrease in sales revenue Increase in investment costs |

| Opportunity | Products and services | Expansion of the bicycle market as a mode of low-carbon mobility | Increase in sales revenue |

Risk management

At our company, the ESG Committee (established in May 2022) discusses the risks of climate change issues and reports to the Board of Directors. The Board of Directors receives the content of discussions and conducts supervision by reviewing them and giving instructions, as necessary.

Indicators and goals

(Indicators)

Scope 1 and Scope 2 CO2 emissions

(Goals)

- 55% reduction in CO2 emissions (Scope 1 & 2) from 2013 levels at domestic and overseas manufacturing sites

- Achieve carbon neutrality by 2050 for the groupwide

Scope 1 and Scope 2 CO2 emissions

(Goals)

- 55% reduction in CO2 emissions (Scope 1 & 2) from 2013 levels at domestic and overseas manufacturing sites

- Achieve carbon neutrality by 2050 for the groupwide

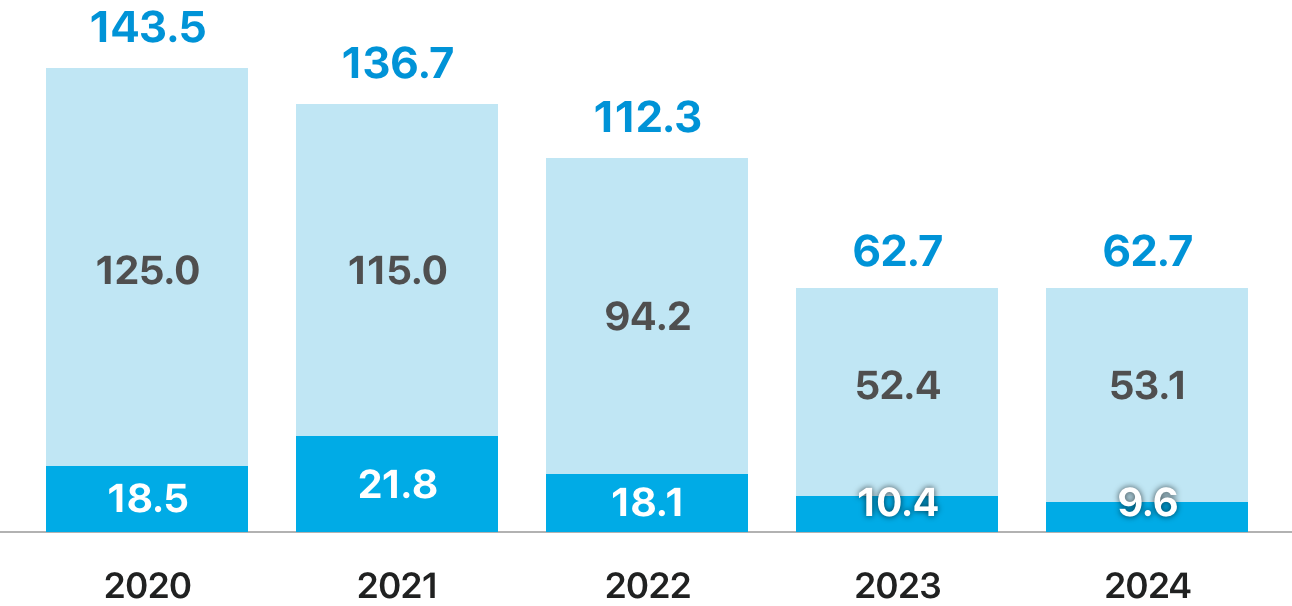

CO2 emissions(Scope 1 + Scop 2)

Boundary of aggregation: Manufacturing sites of Shimano Inc. and Group manufacturing sites in Japan and overseas

(Thousand t-CO2) Scope 1 Scope 2

- (Notes)

-

- Simple sums and total figures shown may differ because of rounding off.